What to do if you receive an IRS balance due notice for taxes you have already paid.- TAS

How Long Do You Really Have To Respond to an IRS Tax Due Notice? - The Wolf Group

Getting Tax Collections Letters Even After Paying? Do This

IRS Notice CP504: What It Is, What It Means, and How to Respond

IRS Threatens Coloradans Who Already Paid Taxes: 'They're Frightened And They Don't Understand' - CBS Colorado

Locating a Refund - Taxpayer Advocate Service

/wp-content/uploads/20

Taxpayer Advocate Service: Assistance with a Notice of Deficiency - FasterCapital

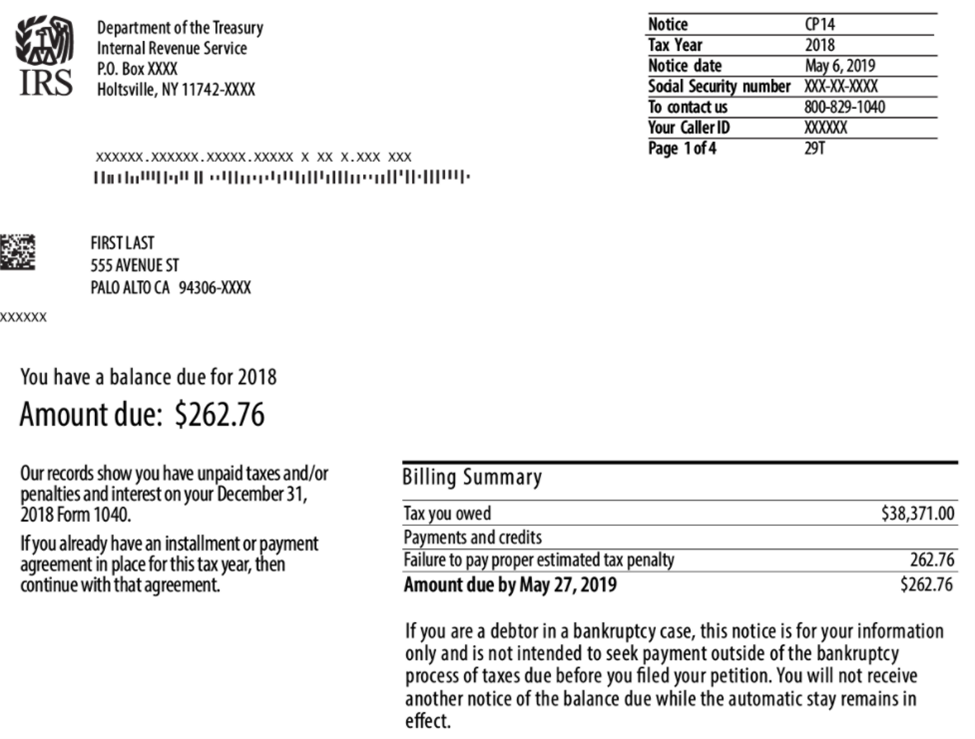

IRS-Tax-Notices-Letters

What to do if you receive an IRS balance due notice for taxes you have already paid.- TAS

I Got My Refund - What is the payment for? IRS TREAS 310 + TAX REF, TAXEIP3 or CHILDCTC explained. -tip-got-a-direct-deposit-from-the-irs-but-not-sure-what-it-is-for/

Notice CP40: The IRS Has Assigned You to a Debt Collector

IRS-Tax-Notices-Letters

Notice CP14 - TAS