ITR for Income upto 5 Lakh: Why you should file ITR even if your income is less than Rs 5 lakh - The Economic Times

If you have an net taxable income below Rs 5 lakh, then you are eligible for income tax rebate u/s 87A which will essentially make your tax liability nil. Nonetheless you should file ITR because every person whose income is above the basic exemption limit is mandated to do so.

Income Tax Slabs 2024-25 Budget 2024 Updates: How will Budget 2024 impact you? Taxpayers must know - The Economic Times

File ITR If Income Is Less Than 5 Lakhs, When to File ITR?

File ITR If Income Is Less Than 5 Lakhs, When to File ITR?

How to file ITR-1 for FY 2022-23 with salary, income from house

Income Tax Return (ITR) : How to File ITR Online for FY 2022-23

Smart ways to file your income tax return; DIY vs assisted ITR filing via private portals - The Economic Times

Income Tax: How reachable is zero-tax income level of Rs 5 lakh using deductions, exemptions?

new tax regime: Earning Rs 12-15 lakh annually? Old or new income

What is ITR U Filing and How Does It Work?

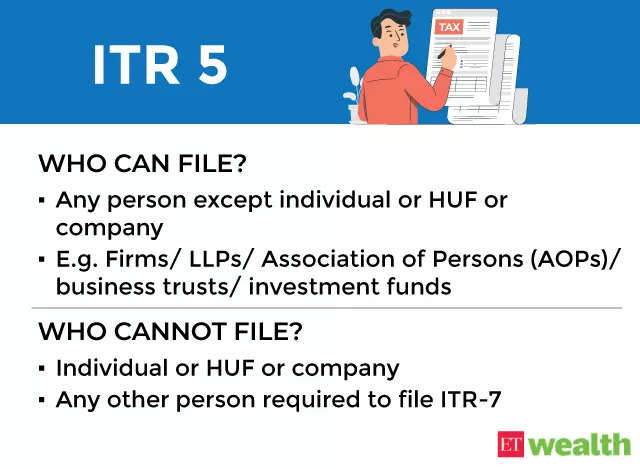

ITR filing for FY 2022-23: Which income tax return form applies to

ITR U – What is ITR-U Form and How to File ITR-U