Who is a 'Person' under S. 2(31) of Income Tax Act in India

Find out what constitutes a 'person' under Section 2(31) of the Income Tax Act in India and what it means for tax purposes.

Kabir & Associates

Understanding Section 2(31) of the Income Tax Act: Implications and FAQs – Marg ERP Blog

EXPLAINED Section 54F of Income Tax Act: How to minimise capital gains tax on gold, residential property

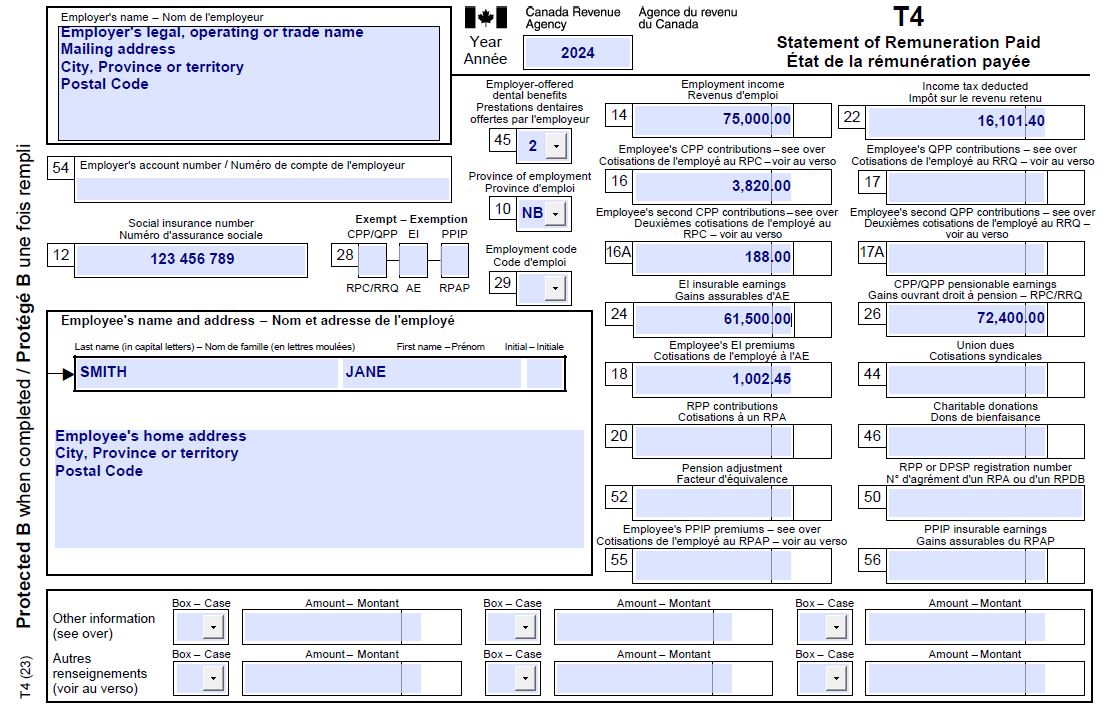

T4 slip – Employers

What is section 80DDB and who is eligible for tax exemption under it

SOLUTION: Income tax introduction - Studypool

Publication 17 (2023), Your Federal Income Tax

:max_bytes(150000):strip_icc()/consumption-tax.asp_FINAL-96e3b673009d46b8b71253303e0efa38.png)

Consumption Tax: Definition, Types, vs. Income Tax

Rangarajan chilkur on X: By Divine grace its clear from below analysis that there is actually no need to amend the Citizenship Act; Central Govt is duty bound to register all Hindu

Global electric car sales rose 31% in 2023 - Rho Motion

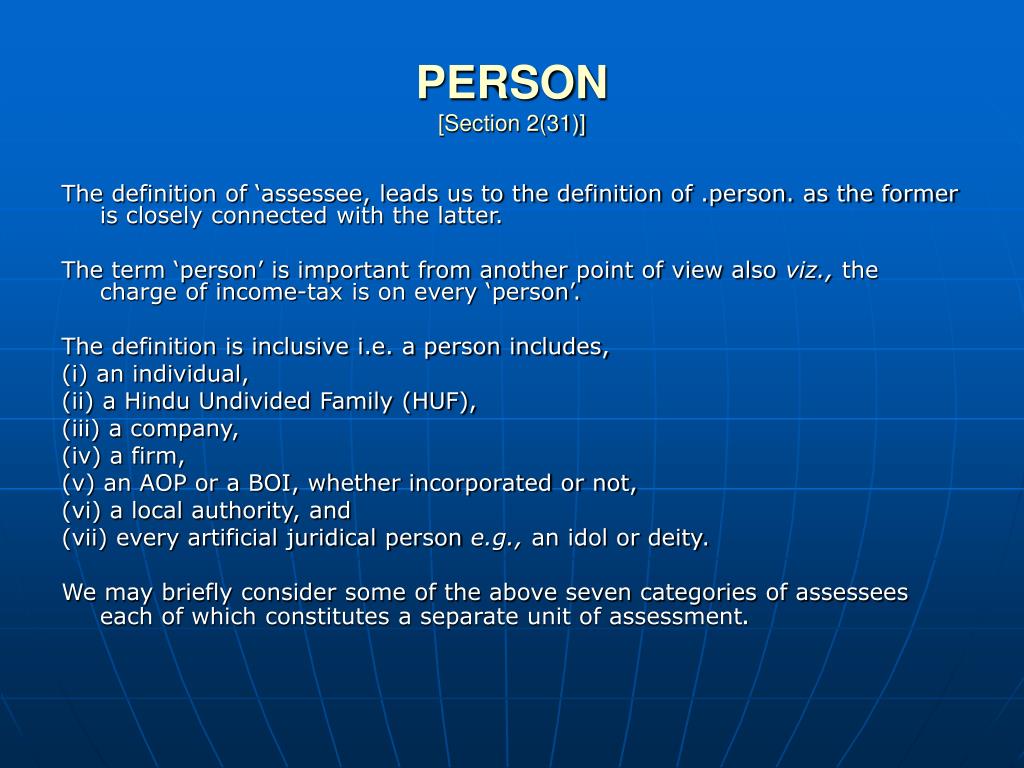

Definition of Person and Taxability under Income Tax Law

PPT - IMPORTANT DEFINITIONS IN THE INCOME-TAX ACT, 1961 PowerPoint Presentation - ID:1059883

21 Things You May Not Know About the Indian Act: Helping Canadians Make Reconciliation with Indigenous Peoples a Reality: Joseph, Bob: 9780995266520: Books