Advances in Japanese Business and Economics: Property Price Index

Arrives by Mon, Apr 8 Buy Advances in Japanese Business and Economics: Property Price Index: Theory and Practice (Hardcover) at

This book answers the question of how exactly property price indexes should be constructed.

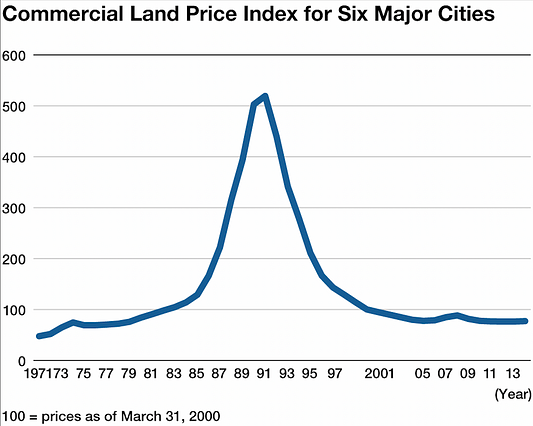

The formation and collapse of property bubbles has had a profound impact on the economic administration of many nations. The property price bubble that began around the mid-1980s in Japan has been called the 20th century's biggest bubble. In its aftermath, the country faced a period of long-term economic stagnation dubbed the lost decade. Sweden and the United States have also faced collapses of property bubbles in the 20th and early 21st centuries, respectively.

This book provides practical examples of how the theory of property price indexes can be applied to the issues of property as a non-homogenous good and a technological and environmental change.

Is Japan's economy at a turning point?

Japan's property price index illustrates recent growth in house

Turning Japanese? - Mason Stevens

Japan stocks surge to 34-year high, but rally could slow amid

Japan Residential Property Price Index

A Weakening Yen Puts Japan to the Test

Economy of Japan - Wikipedia

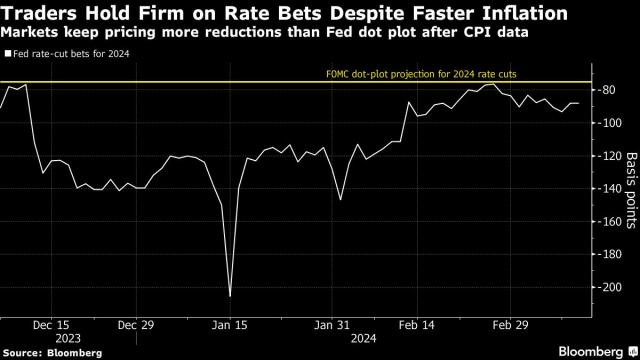

Stocks Struggle Near Record Before Inflation Data: Markets Wrap

This book answers the question of how exactly property price indexes should be constructed., The formation and collapse of property bubbles has had a

Advances in Japanese Business and Economics: Property Price Index: Theory and Practice (Hardcover)

:max_bytes(150000):strip_icc()/dotdash_Final_Trading_GDP_Like_Currency_Trader_Jul_2020-01-2575683fb6894b70b9cf74a3af9468d3.jpg)

Trading GDP Like A Currency Trader

Three-Generation Mortgages? The Japanese Financial Crisis

Inflation Rose to 3.2%, but Overall Price Trends Are Encouraging

Japan RMBS Correlation And Sensitivity Analysis: Land Prices, GDP

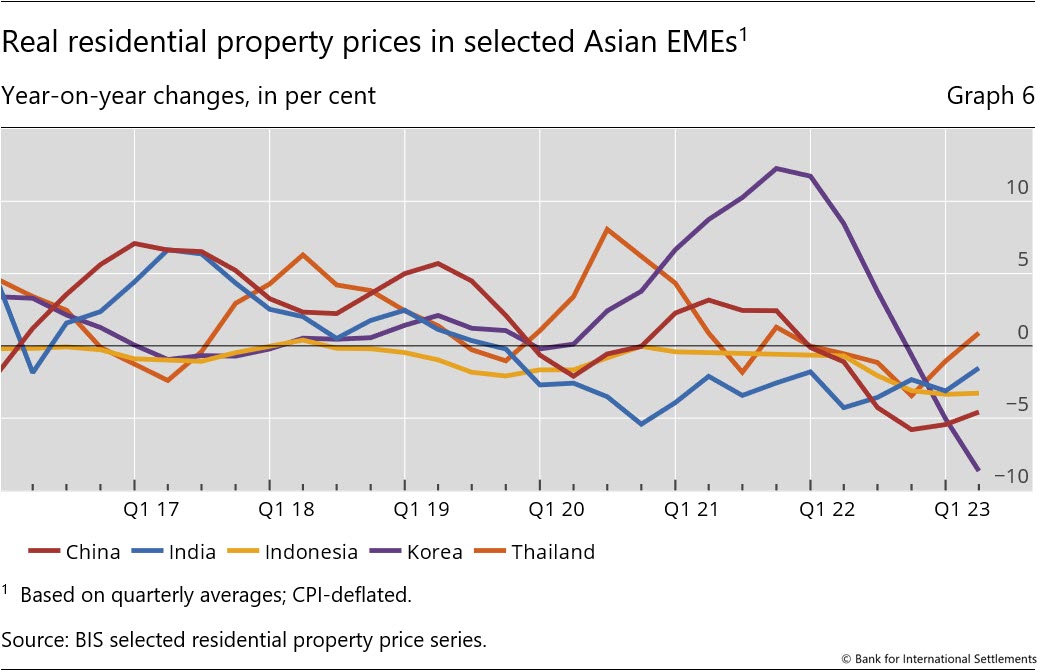

BIS residential property price statistics, Q1 2023