Case Study: QQQ and SPY Buy & Hold vs. The Market Trend Advisory Strategies

We compare a buy and hold strategy with index ETFs QQQ and SPY vs.our Market Trend Advisory returns. Check out which one had the best return and lowest risk

Case Study: QQQ and SPY Buy & Hold vs. The Market Trend Advisory

Trend Trading Strategy for High Momentum Stocks (with ATR-based

/wp-content/uploads/2022/08/tren

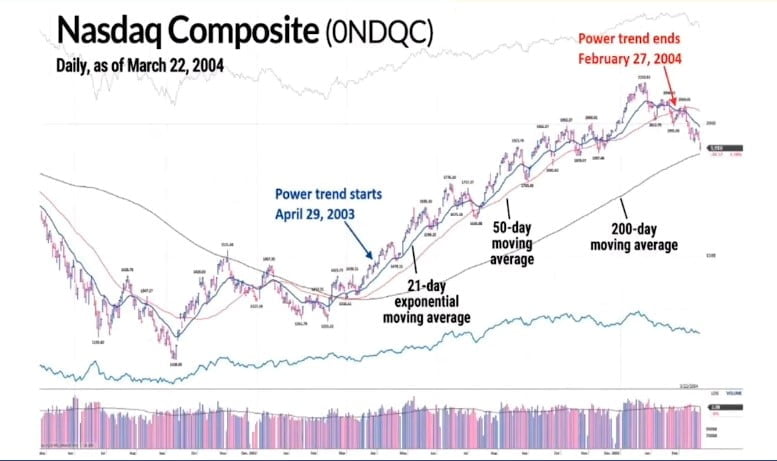

The Power Trend Indicator - Lifetime Investor

Case Study: QQQ and SPY Buy & Hold vs. The Market Trend Advisory

Sector Rotations Begin As Small And Mid-Caps Surge - RIA

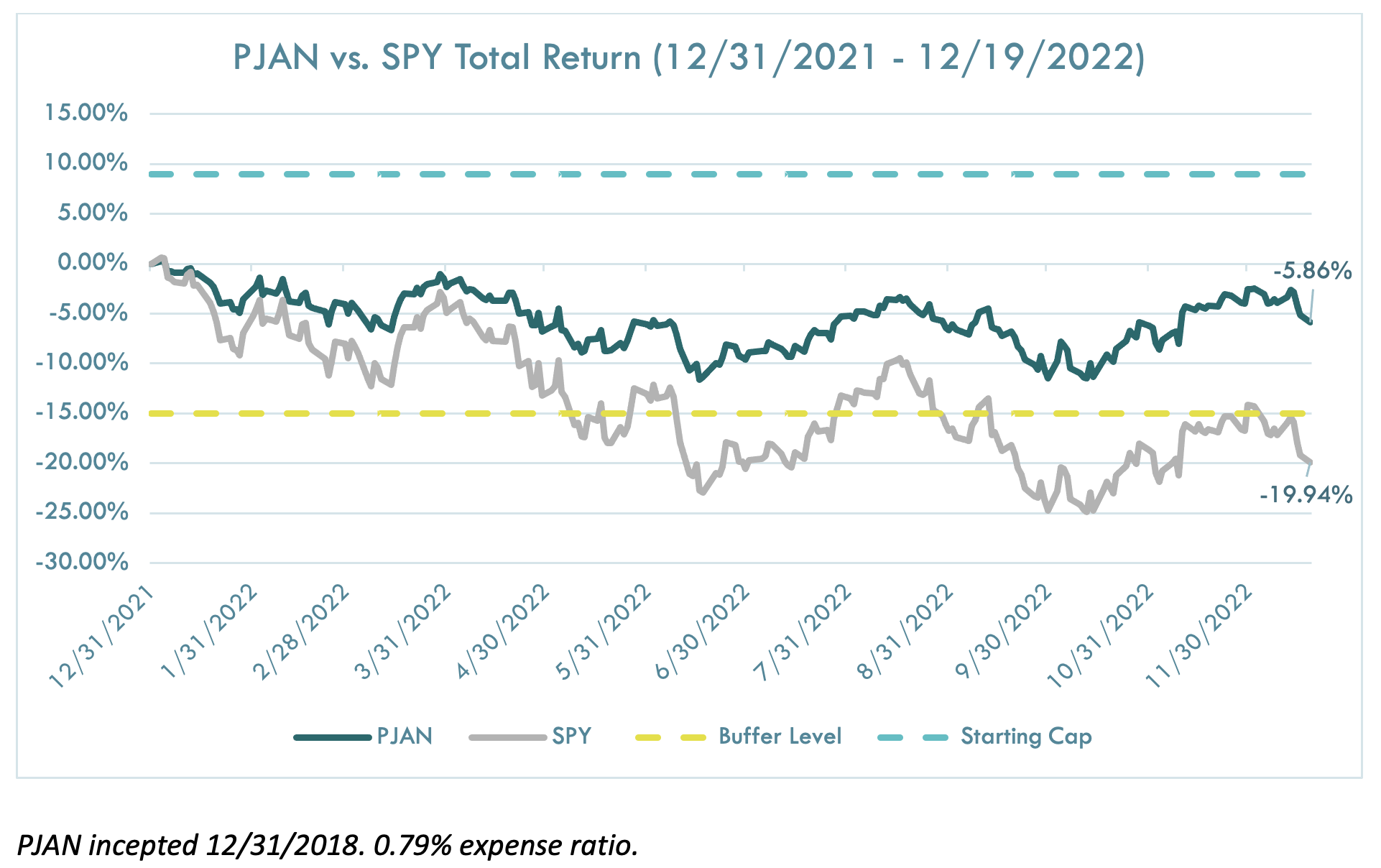

The Year in Defined Outcome ETFs

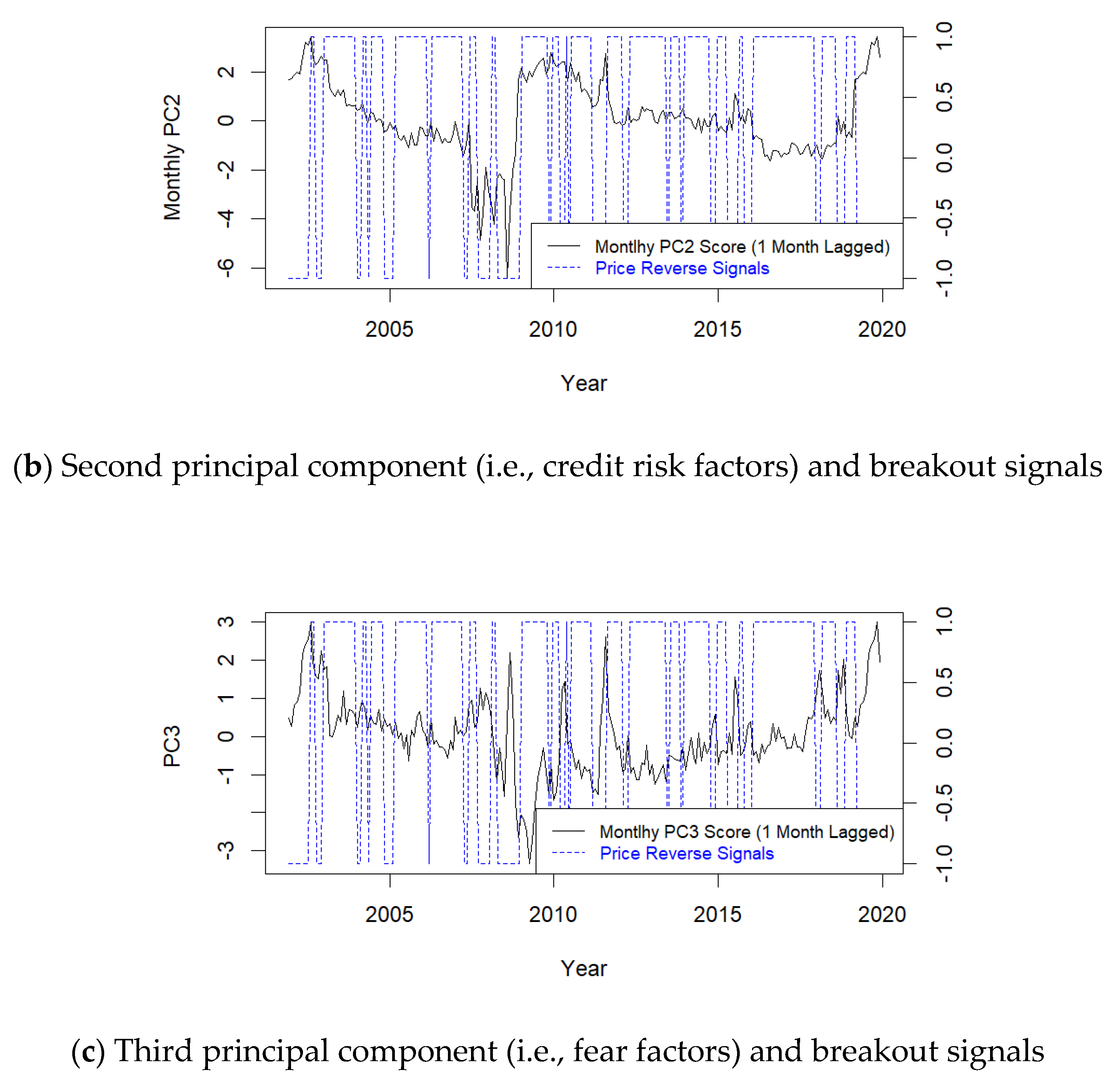

Sustainability, Free Full-Text

QQQ Vs SPY: Difference, Performance & Which is Better

Chart Advisor: Gold Gets Hit – Gold hits its lowest level since

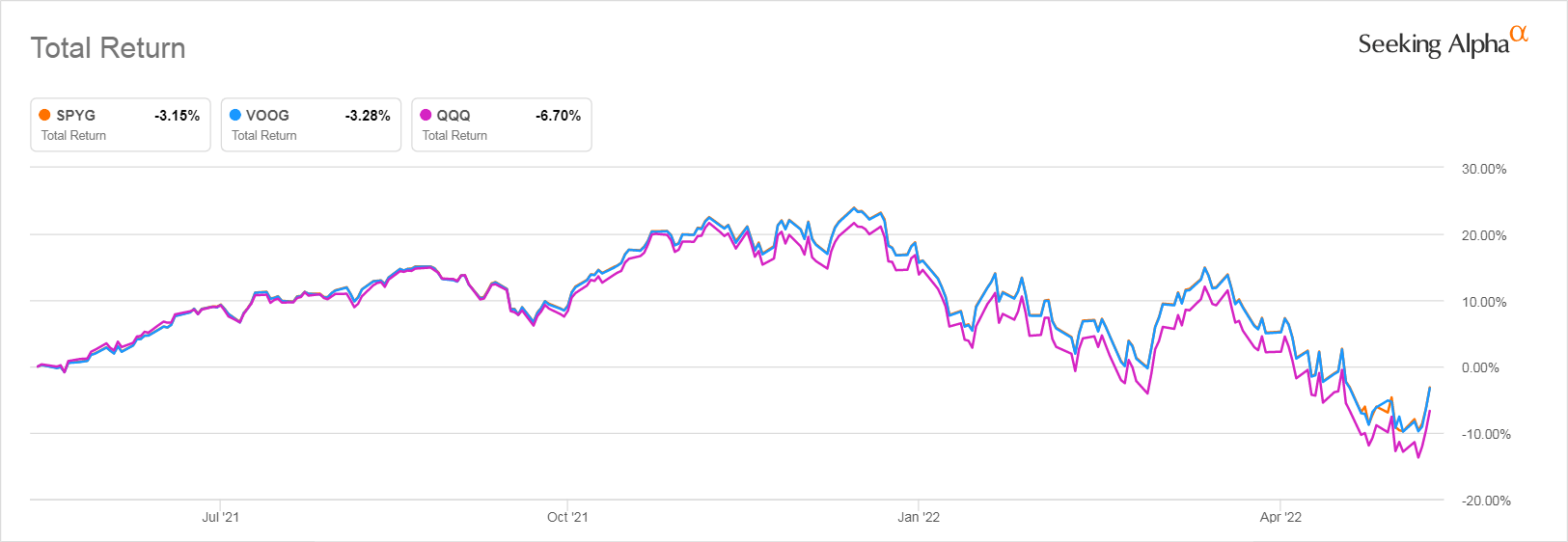

QQQ Vs SPYG: Which Is The Best Growth ETF For The Future? (NASDAQ

Will Rising Oil Prices Smack the S&P 500? - See It Market

SPY Archives - QUANTITATIVE RESEARCH AND TRADING

A Case Study: Buy and Hold vs Double-Cost Averaging — Which is