High-water Mark - Breaking Down Finance

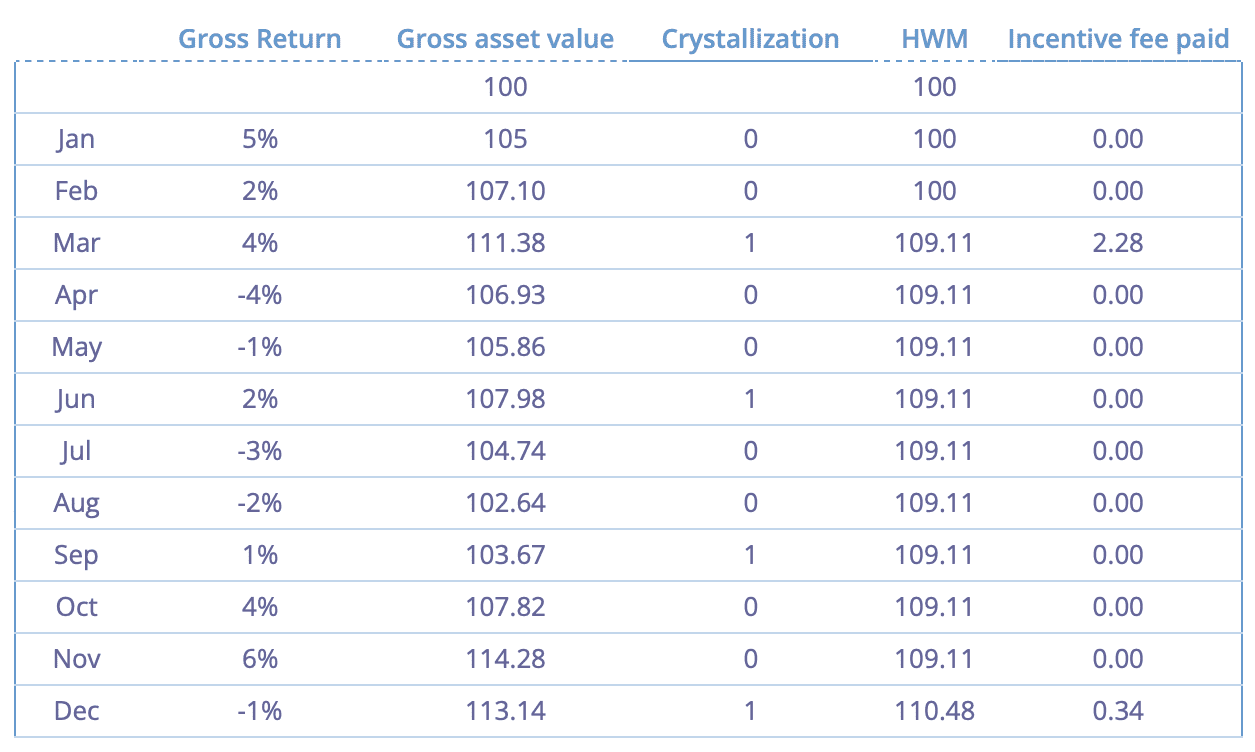

A hedge fund's high-water mark (HWM) ensures that the performance fee is only charged on new profits. Using an Excel spreadsheet, we illustrate how the

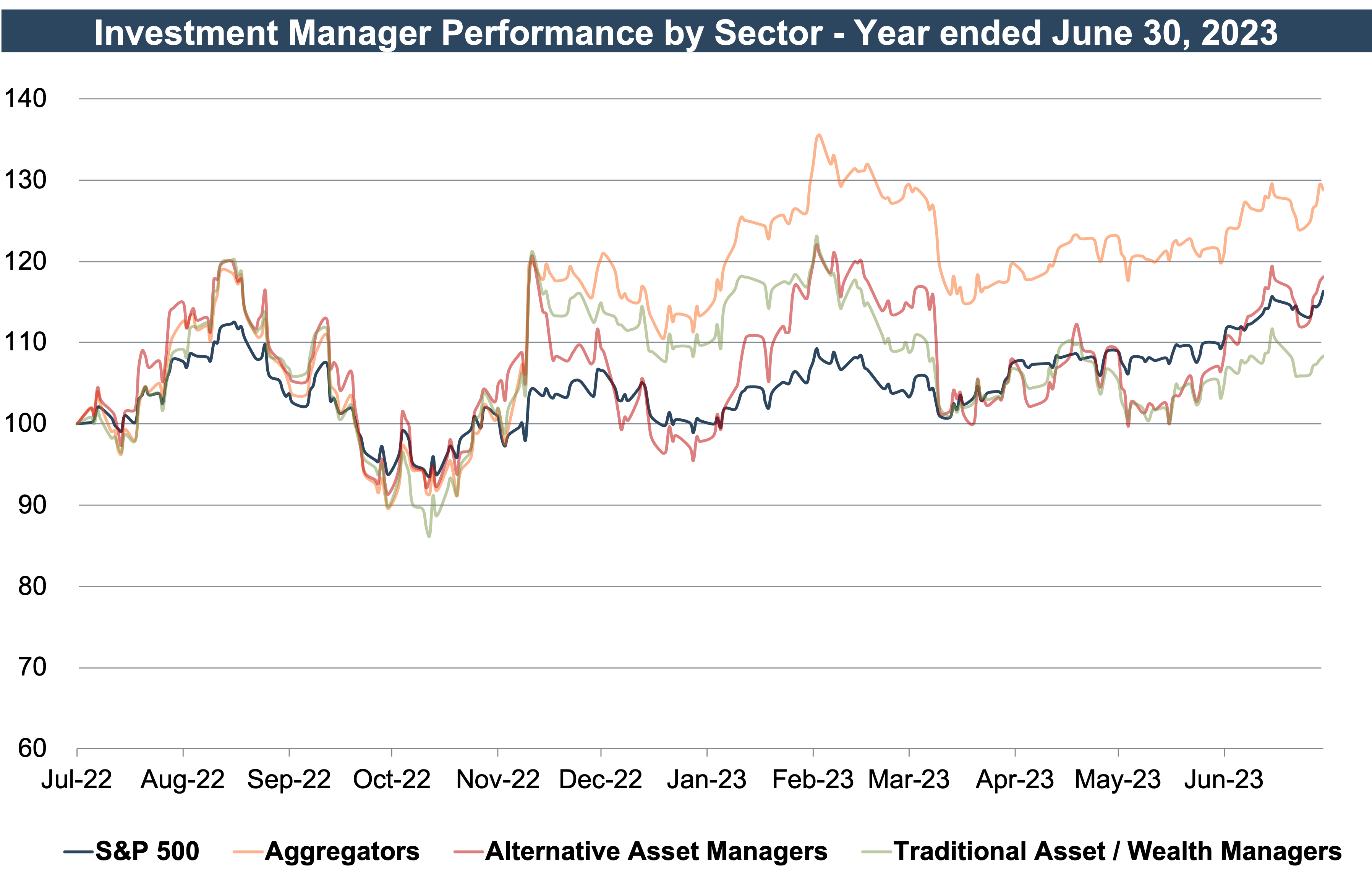

Q2 2023: RIAs Finish Strong Following June's Bull Market - Mercer Capital

SICAV Performance Fee Guide

Wealth Management Highwatermark: Scaling New Heights in Financial Security - FasterCapital

Asset Management Highwatermark: Maximizing Value and Earning Potential - FasterCapital

Different Flavors of High Water Marks – Mt.Cook Financial

A High-Water Mark Strategic Financial Services

Capital Highwatermark: Scaling New Peaks in Financial Resources - FasterCapital

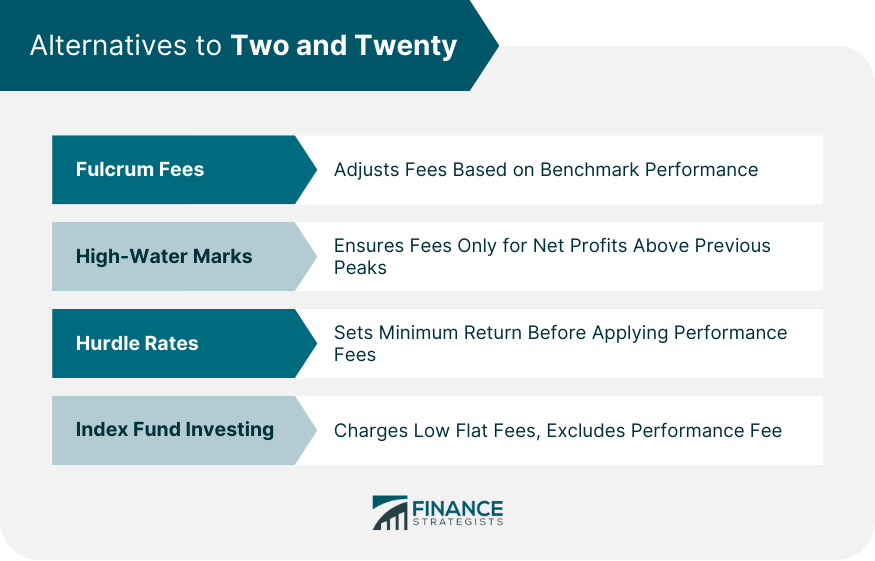

Two and Twenty Definition, Calculation, & Advantages

Beware High-Water Mark Thinking

Don't Anchor Yourself To Your Portfolio High-Water Mark — My Money Blog

Hedge Fund High Water Mark Probability and Persistence - CXO Advisory

Hedge Fund Fee Structure, High Water Mark and Hurdle Rate - Finance Train

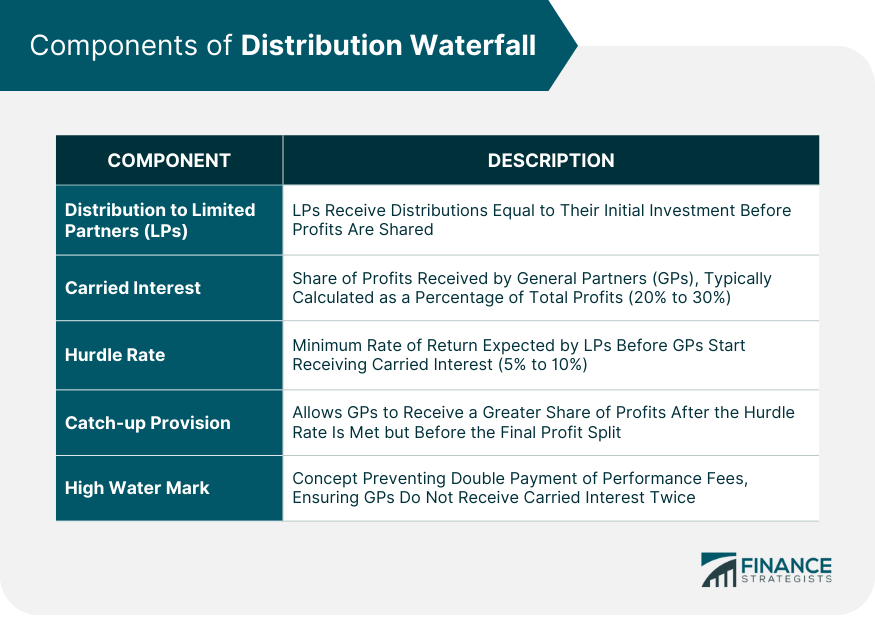

Distribution Waterfall Definition, Components, and Impact

High-Water Mark: What It Means in Finance, With Examples