Blog Post: Day 3 of new $QQQ short term down-trend and the GMI

I am on the defense in my trading account. I hold some SQQQ, a 3X leveraged ETF which is designed to rise three times as much as QQQ falls. It is the opposite of TQQQ which rises three times as much as QQQ rises. I noted last post that in the past few years 40%

Blog post: GMI turns Green; $QQQ short term down-trend likely to

Blog Post; 51 US new highs and 114 new lows; Indexes weakening and

Blog Post: Day 4 of $QQQ short term down-trend; 129 new US highs

Blog Post: Day 11 of $QQQ short term up-trend; 62 US new highs and

Blog Post: Day 1 of new $QQQ short term up-trend; 23 new US highs, 433 lows and 6 at ATH; Split market with tech stocks outperforming, but GMI remains Red; Weekly 10:30

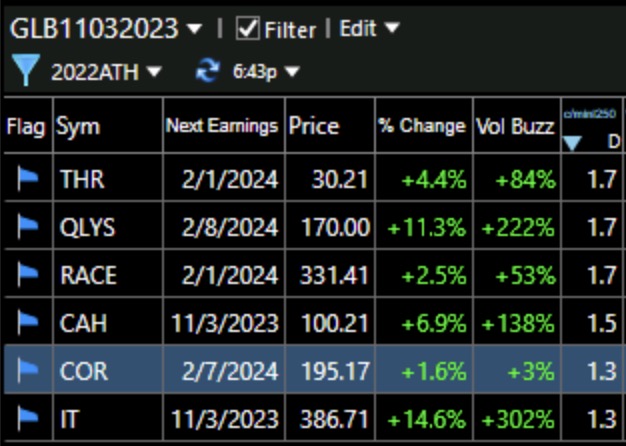

QQQ remains in Stage 2 up-trend; GMI2=8 (of 8)

Blog Post: Day 1 of $QQQ short term down-trend; 64 US new highs

Blog Post: Day 14 of $QQQ short term up-trend; GMI=5 now that QQQ

NASDAQ 100 Signal Says QQQ Could Post Impressive Multi-Year Gains

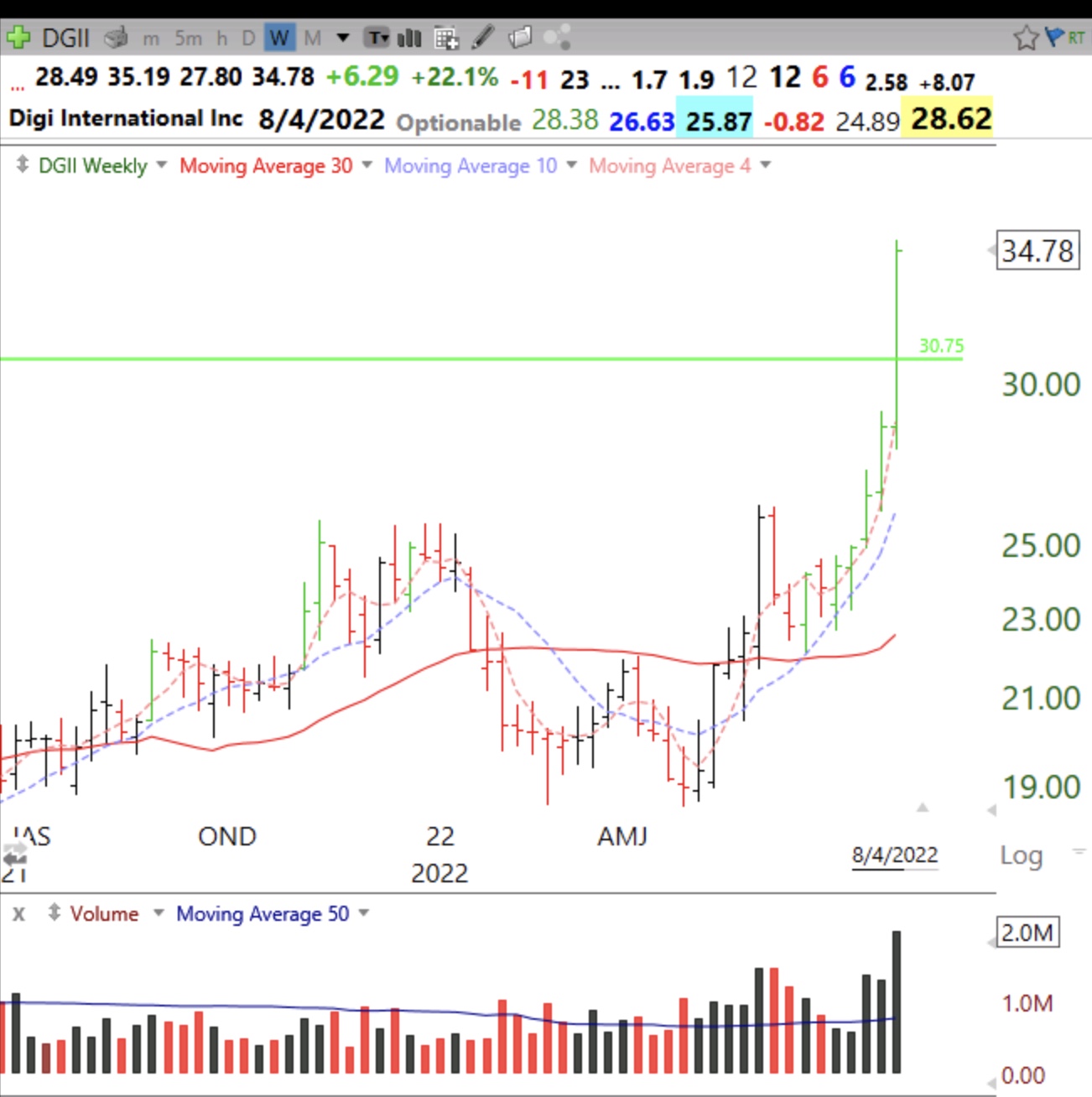

Blog Post: Day 1 of new $QQQ short term up-trend; GMI=4 and could

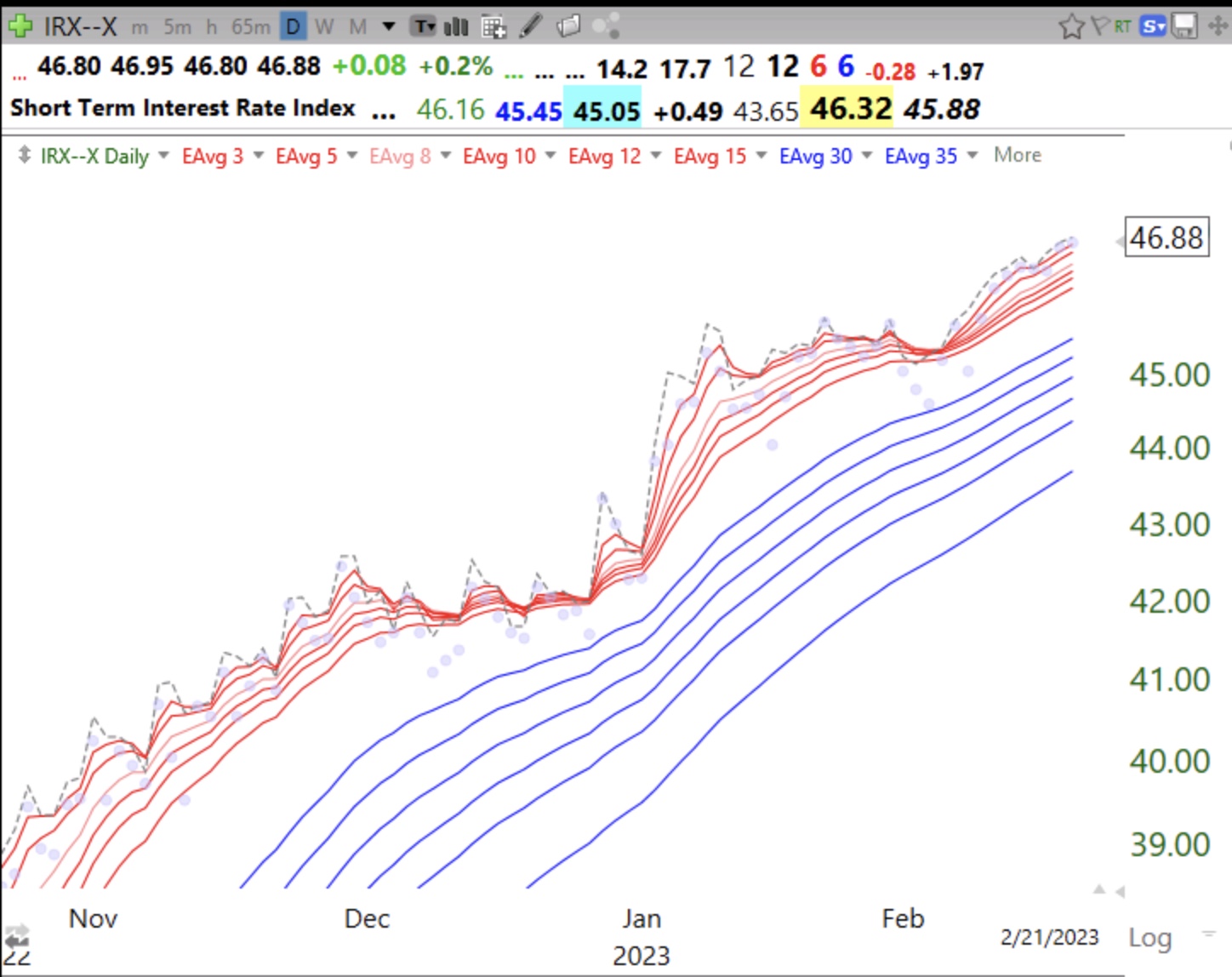

Trading the QQQ in Three Timeframes

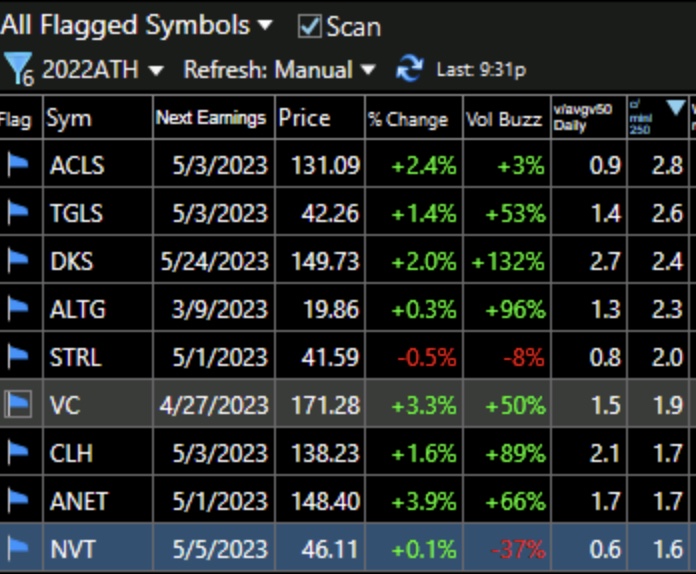

Blog Post: Day 40 of $QQQ short term up-trend; See how my blue dot

CHART OF THE DAY: Long Gold vs Short QQQ Core Positions